“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1″―

“Remember that the stock market is a manic depressive.”―

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”―

“The most important thing to do if you find yourself in a hole is to stop digging.”―

“Price is what you pay. Value is what you get.”―

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”―

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”―

“Risk comes from not knowing what you are doing.”―

“Never invest in a business you cannot understand.”―

“If returns are going to be 7 or 8 percent and you’re paying 1 percent for fees, that makes an enormous difference in how much money you’re going to have in retirement.”―

“In the business world, the rearview mirror is always clearer than the windshield.”―

“Time is the friend of the wonderful company, the enemy of the mediocre.”―

“The three most important words in investing are margin of safety.”―

“It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”―

“If a business does well, the stock eventually follows.”―

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”―

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”―

“All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.”―

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”―

“It is a terrible mistake for investors with long-term horizons — among them pension funds, college endowments, and savings-minded individuals — to measure their investment’ risk’ by their portfolio’s ratio of bonds to stocks.”―

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.“―

“The stock market is designed to transfer money from the active to the patient.”―

“If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”―

“Our favorite holding period is forever.”―

“An investor should act as though he had a lifetime decision card with just twenty punches on it.”―

“Do not take yearly results too seriously. Instead, focus on four or five-year averages.”―

“Time is the friend of the wonderful company, the enemy of the mediocre.”―

“Why not invest your assets in the companies you really like? As Mae West said, ‘Too much of a good thing can be wonderful.'”―

“The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.“―

“There seems to be some perverse human characteristic that likes to make easy things difficult.”―

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”―

“Success in investing doesn’t correlate with IQ … what you need is the temperament to control the urges that get other people into trouble in investing.“―

“The stock market is a no-called-strike game. You don’t have to swing at everything — you can wait for your pitch.”―

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”―

“What counts for most people in investing vs saving is not how much they know, but rather how realistically they define what they don’t know.”―

“There is nothing wrong with a ‘know nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.”―

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”―

“Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.”―

“It’s better to have a partial interest in the Hope diamond than to own all of a rhinestone.”―

“You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”―

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”―

“Wide diversification is only required when investors do not understand what they are doing.”―

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”―

“We always live in an uncertain world. What is certain is that the United States will go forward over time.”―

“For 240 years, it’s been a terrible mistake to bet against America, and now is no time to start.“―

“American business — and consequently a basket of stocks — is virtually certain to be worth far more in the years ahead.“―

“I won’t” say if my candidate doesn’t win, and probably half the time they haven’t, I’m going to take my ball and go home.”―

“Widespread fear is your friend as an investor because it serves up bargain purchases.”―

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”―

“The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they’re on the operating table.”―

“Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”―

“The most common cause of low prices is pessimism—sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism but because we like the prices it produces. It’s optimism that is the enemy of the rational buyer.”―

“After 25 years of buying and supervising a great variety of businesses, Charlie [Munger] and I have not learned how to solve difficult business problems. What we have learned is to avoid them.”―

“Speculation is most dangerous when it looks easiest.”―

“Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”―

“Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game.”―

“You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long, dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.―

“If past history was all that is needed to play the game of money, the richest people would be librarians.“―

“The investor of today does not profit from yesterday’s growth.“―

“What we learn from history is that people don’t learn from history.”―

“…not doing what we love in the name of greed is very poor management of our lives.“―

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.“―

“Money is not everything. Make sure you earn a lot before speaking such nonsense.”―

“Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”―

“Only when the tide goes out do you discover who’s been swimming naked.”―

“Predicting rain doesn’t count, building the ark does.“―

“The years ahead will occasionally deliver major market declines — even panics — that will affect virtually all stocks. No one can tell you when these traumas will occur.”―

“This does not bother Charlie [Munger] and me. Indeed, we enjoy such price declines if we have funds available to increase our positions.“―

“The best chance to deploy capital is when things are going down.”―

“It’s been an ideal period for investors: A climate of fear is their best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”―

“It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”―

“Of the billionaires I have known, money just brings out the basic traits in them. If they were jerks before they had money, they are simply jerks with a billion dollars.”―

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.“―

“Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.”―

“If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster.“―

“Basically, when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you actually do love you.”―

“I always knew I was going to be rich. I don’t think I ever doubted it for a minute.“―

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.”―

“Honesty is a very expensive gift. Don’t expect it from cheap people.”―

“Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.”―

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.”―

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”―

“If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”―

“The difference between successful people and really successful people is that really successful people say no to almost everything.“―

“You’ve gotta keep control of your time, and you can’t unless you say no. You can’t let people set your agenda in life.”―

“In the world of business, the people who are most successful are those who are doing what they love.”―

“It is not necessary to do extraordinary things to get extraordinary results.”―

“You know… you keep doing the same things and you keep getting the same result over and over again.”―

“Tell me who your heroes are and I’ll tell you who you’ll turn out to be.“―

“The best thing I did was to choose the right heroes.”―

“Chains of habit are too light to be felt until they are too heavy to be broken.”―

“Investors should remember that excitement and expenses are their enemies.”―

“The most important investment you can make is in yourself.”―

“I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business.”―

“Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.”―

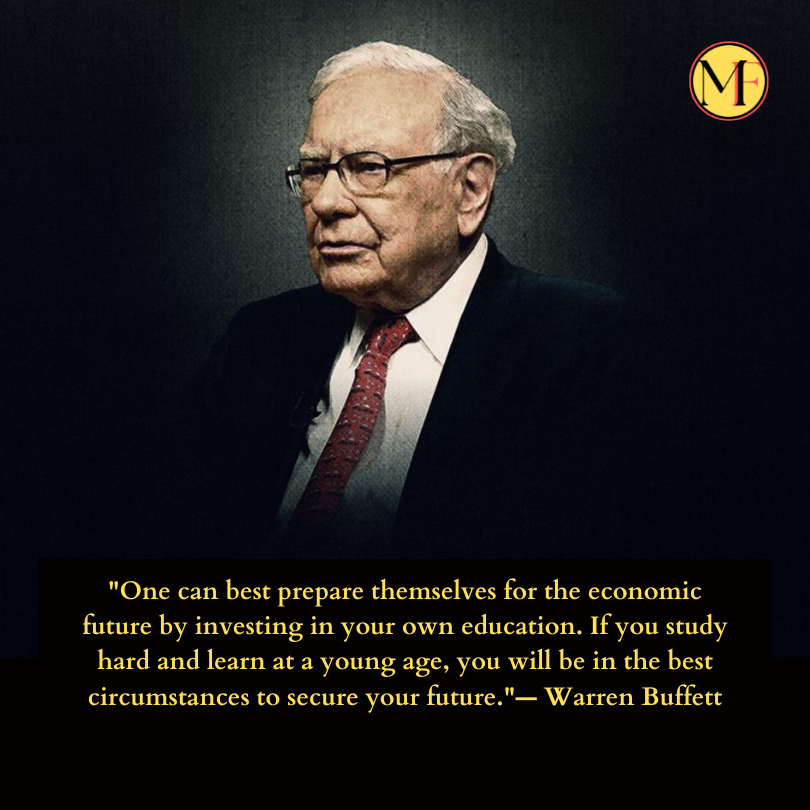

“One can best prepare themselves for the economic future by investing in your own education. If you study hard and learn at a young age, you will be in the best circumstances to secure your future.”―

Welcome to our blog! My name is Yuvraj Kore, and I am a blogger who has been exploring the world of blogging since 2017. It all started back in 2014 when I attended a digital marketing program at college and learned about the intriguing world of blogging.